Content

- Which TurboTax Version Do You Need?

- Tax Calculators & Tools

- Great Mobile Tax Calculator, I Just Wish I Could See My State Tax Estimate As Well.

- Just answer a few simple questions about your life, income, and expenses, and our free tax

- Added Benefits of TurboTax Available, Often for a Fee

- Your tax prep comes with built-in reassurance.

In 1992, Edmontonians and University of Alberta graduates Bruce Johnson and Chad Frederick had built a tax preparation product called WINTAX – Canada’s first Microsoft Windows-based personal tax preparation software. In 1993, they agreed to be acquired by Chipsoft, manufacturer of the U.S. personal intuit 2021 tax calculator income tax software TurboTax. Shortly after the WINTAX acquisition, Chipsoft agreed to merge with Intuit, the developer of the Quicken financial software. Intuit Canada continued to update and support the WINTAX software, which was renamed QuickTax in 1995 and then renamed TurboTax in 2010.

Federal and state laws and regulations are complex and are subject to change. Changes in such laws and regulations may have a material impact on pre- and/or after-tax investment results. Fidelity makes no warranties with regard to such information or results obtained by its use.

Which TurboTax Version Do You Need?

We’ve updated your experience with a new dialog box that can auto-detect open QuickBooks files and allows you to set beginning and end dates, and the basis for a client’s return. Tax Pros can now batch send eSig requests on the same document from multiple signers at one go. Improved Account Management makes new user onboarding seamless and easy for current users. Here’s a look at the various ways you can find answers and get guidance when filing your return with TurboTax. The Deluxe, Premier and Self-Employed packages integrate ItsDeductible, a feature — and standalone mobile app — that’s helpful for quickly finding the deduction value of donated clothes, household items and other objects.

The November 21, 2005 edition of Business Week featured an article titled “50 Smart Ways to Use the Web” in which TaxAlmanac was selected as one of the 50. The product made the short list as one of the 7 in the collaboration category. Intuit shut down TaxAlmanac effective June 1, 2014. Many of the users have migrated to a new site called TaxProTalk.com.

Tax Calculators & Tools

We don’t have a complicated tax situation, just 2 w-2s, single family home mortgage, and child care expenses. Yes, Cash App Taxes is 100% free for state and federal returns. Even if you‘re taking deductions or credits, it won‘t cost you a penny to file your taxes. Almost all the versions of TurboTax can import your data from the previous year’s TurboTax, Quickbooks, Quicken, or other tax preparation software.

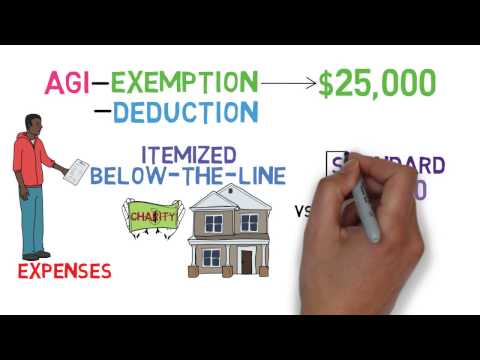

But it’s a clear example of how difficult it is to keep track of what tax-prep services are doing. There’s so much data-sharing wiggle room in most privacy policies—including those from H&R Block and TurboTax—that it’s difficult to predict how they’ll be interpreted. But your mileage may vary, of course, and it can take work to find a good accountant or tax pro. The last tax pro Kaitlyn hired failed to account for all of her family’s medical expenses and incorrectly assigned them the standard deduction, instead of the more-beneficial itemized deduction. As is true of finding a trustworthy dentist or home-improvement contractor, asking people you know for references is usually a good way to go.

Great Mobile Tax Calculator, I Just Wish I Could See My State Tax Estimate As Well.

If you’re unfamiliar with all of the tax forms, deductions, and credits that apply to your tax situation, it can be tough to know which version of TurboTax you need. You could go through the entire tax-prep process, only to find you don’t qualify for the free or lower-price version of the software and must pay a hefty fee to file. This can mean wasted time if you decide you want to find a cheaper alternative. TaxAct peppers helpful tips throughout its program, like suggesting you use a Flexible Spending Account to reduce your income for the next year. There’s no chat support option, and customer service reps frequently sounded impatient when we asked common tax filing questions over the phone.

Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. Description of benefits and details at hrblock.com/guarantees. Federal pricing will vary based upon individual taxpayer circumstances and is finalized at the time of filing.

Frequently asked questions

Use this federal gross pay calculator to gross up wages based on net pay. For example, if an employee receives $500 in take-home pay, this calculator can be used to calculate the gross amount that must be used when calculating payroll taxes. It determines the amount of gross wages before taxes and deductions that are withheld, given a specific take-home pay amount. South Carolina offers several options for filing and paying your taxes online. A government-run tax filing system, often known as return-free filing, is already a reality in many countries around the world.